|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

The Best Company to Refinance Mortgage: A Comprehensive GuideWhen considering refinancing your mortgage, choosing the right company is crucial. This guide will explore top considerations and options for refinancing, ensuring you make an informed decision. Understanding Mortgage RefinancingRefinancing a mortgage involves replacing your existing loan with a new one, often to secure better terms or lower interest rates. It's a strategy many homeowners use to save money over time or to access cash for home improvements. Why Refinance?

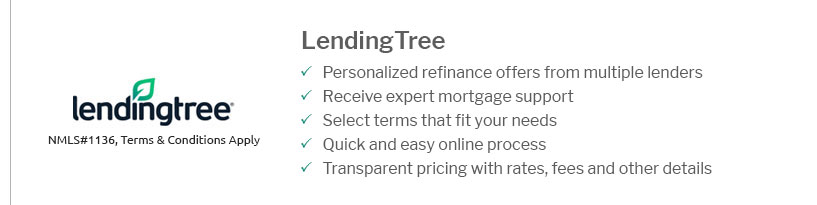

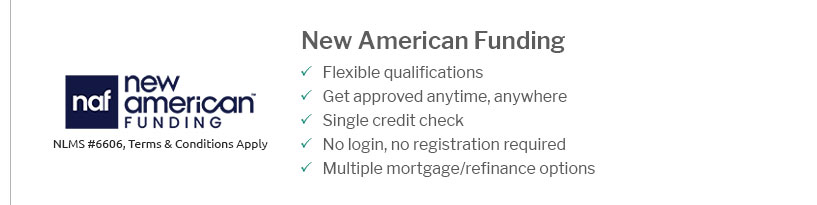

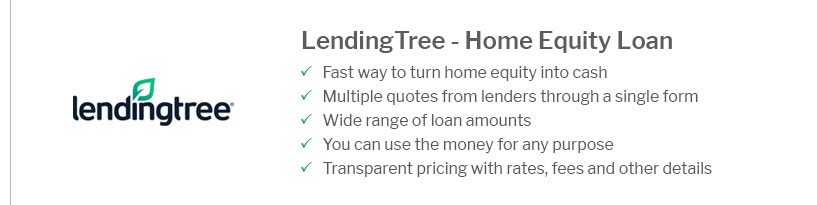

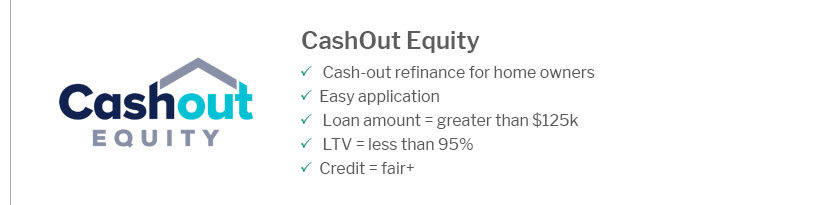

Considerations Before RefinancingBefore deciding to refinance, it's essential to evaluate the house appraisal for refinance and understand the potential costs involved. Top Companies for Mortgage RefinancingCompany Selection CriteriaSelecting the best refinancing company depends on several factors, including customer service, rates, and overall satisfaction. Leading Companies

Steps to Refinance Your MortgageRefinancing involves several steps, starting with an application and ending with the closing process. It's vital to understand each stage to avoid surprises. Application ProcessBegin by gathering all necessary documents, including proof of income and credit reports. Use online tools to calculate how much to refinance home and assess potential savings. Closing CostsBe prepared for closing costs, which can include appraisal fees, title insurance, and other expenses. These should be factored into your decision-making process. Frequently Asked QuestionsWhat is the best time to refinance a mortgage?The best time to refinance is when interest rates are lower than your current rate, and you plan to stay in your home long enough to recoup closing costs. How much can I save by refinancing?Savings depend on the difference in interest rates and the remaining balance on your mortgage. Use online calculators to estimate potential savings. Is refinancing worth the cost?Refinancing is generally worth it if the savings from a lower interest rate outweigh the costs involved. By understanding your options and carefully considering the pros and cons, you can choose the best company to refinance your mortgage and achieve your financial goals. https://www.reddit.com/r/Mortgages/comments/1fyzjit/current_options_for_refinance_rocket_loan_depot/

Go with a Mortgage Broker and not direct to lender. This is called the Wholesale channel & pricing is significantly better. NEXA, C2, Loan ... https://themortgagereports.com/69718/best-refinance-rates-top-lender-rankings

Best VA refinance rates. Compare VA loan refinance rates. Start here. Wells Fargo Bank: 3.36%; Rocket Mortgage: 4.50%; Pennymac: ... https://money.usnews.com/loans/rates/mortgages/mortgage-refinance

Average Mortgage Rates, Daily ; VA 15 Year Fixed Refinance. 5.866%. 6.5% ; FHA 30 Year Fixed Refinance. 6.614%. 7.431% ; FHA 15 Year Fixed Refinance. 6.025%. 6.895 ...

|

|---|